February and March are number-crunching months for Iowa’s cities, towns and county governments. The Perry City Council, marking the three-quarter point in its 2015 budget, this week approved a balanced budget for fiscal year 2016 and also received a clean bill of health from the state auditor on its 2014 budget.

“I’m glad we held the line on next year’s budget.”

City revenues for 2016 are expected to be about $9.1 million, including $2.5 million in property taxes, $2.4 million in fees and service charges, $800,000 in Local Option Sales Taxes and $765,000 in Iowa road use taxes.

The 2016 budget was drafted before the state legislature passed a 10-cent-per-gallon hike in the gas tax. The increase will mean more revenues for Perry in the form of road use taxes, which will be used for street repairs and overlays.

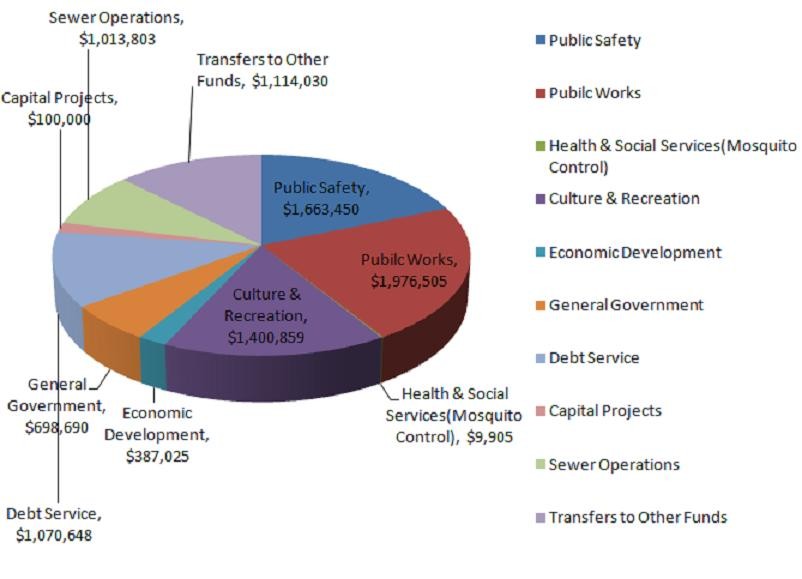

Expenditures in next year’s budget are estimated at about $8.9 million. The largest items on the cost side are $2 million for public works, $1.7 million for police and $1.4 million for culture and recreation.

The overall tax levy rate will see a slight increase over the 2015 rate, from 17.79 to 17.87 per $1,000 of taxable valuation. There was a $1.12 million increase in the value of taxable property in Perry over the previous year, according to the office of the Dallas County Assessor..

“I’m glad we held the line on next year’s budget,” said Perry Mayor Pro Tem Phil Stone, who chaired the March 2 meeting and public hearing.

“Our cuts to the line-item budget were already close to the bone or even at the bone,” said council member Dr. Randy McCaulley. “Any further cuts would have had to come out of city services,” he said.

Susie Moorhead, Perry’s finance officer, has worked a lot of overtime in the last six weeks, repeatedly holding meetings and workshops with both city councilors and heads of Perry’s seven service departments: public safety, public works, health and social services, culture and recreation, community and economic development, business-type activities and general government.

“When we receive the capital expenditure requests, we ask the department heads to prioritize the requests,” Moorhead said. “We make sure each department receives adequate, if not generous, funding for their capital requests.”

After paying down previous loans and bonds, the city expects to have about $500,000 in Local Option Property Tax revenues to put toward capital spending in 2016, but city departments asked for almost twice that amount in their original budget line-item requests submitted in February.

The first round of work sessions, when department heads met with Moorhead, City Administrator Butch Niebuhr and Assistant City Administrator Sven Peterson, saw that gap closed to about $30,000, and it was further cut at the second round of work sessions.

Among the round-two budget cuts were $2,500 from the Perry Police Department’s vehicle repair and investigation line items, $8,000 from the garbage and recycling contract services, $1,550 from the library’s part-time wages, $1,000 from the Parks Department’s budget for fuel and vehicle repairs, $3,000 from the Recreation Department’s operating supply line item and $1,000 from the City Hall’s expense budget.

“We make sure each department receives adequate, if not generous, funding for their capital requests.”

According to Moorhead, General Fund revenues for 2016 are expected to be $3.24 million, about 1.75 percent higher than this year’s tax and fee takings. General Fund expenditures are also expected to be $3.24 million, leaving the city with a tiny $421 surplus.

“When we review the capital expenditure requests with the department heads, we also discuss other funding possibilities,” Moorhead said, “such as grants or sharing of equipment between departments. We also look at expenses that may fit into their operating expenditures from the current year.”

Moorhead cited several examples of economizing by sharing resources between departments. The Parks and Recreation Department requested $3,000 for new sand volleyball standards at Pattee Park. Instead of budgeting this as a capital expenditure, Moorhead said, it was agreed the Street Department would build the volleyball standards simply at the cost of materials.

“We always look at how departments can work together to better utilize city funds,” Moorhead said.

Older equipment is also passed down to other departments when new equipment is purchased. For example, the Parks Departments uses a truck passed down from the Street Department, Moorhead said, and the Water Pollution Control Facility uses a second-hand lawn mower from the Parks Department.

“During the budget process, we also look at new revenue sources,” Moorhead said, “and capital expenditure requests that can be used to generate or increase revenues are always high on the list.”

Among new revenue sources first proposed in the 2015 budget and continuing in 2016 are contracting cemetery services to neighboring townships, changing the city’s fine structure from fines payable through the county magistrate to fines payable directly to the city and allowing the smaller shelter houses at Pattee Park to be reserved.

Another promising revenue source is a regular system of annual inspections of the city’s many residential rental properties, an arrangement that could dovetail with other efforts in play to improve the quality and quantity of Perry’s housing stock.

The city council’s cautious and conservative approach to future financing also received validation in the form of the auditor’s report on the 2014 Perry budget.

Andy Nielsen, department auditor with the Iowa State Auditor’s office, and Jennifer Campbell, audit manager, told the city council Perry is “in good shape” in terms of fiscal health.

Nielsen particularly praised the city’s restraint in keeping well within its borrowing limits. Perry has a $12.7 million debt limit and currently carries $6.7 million in debt, he said.

“It’s the only thing that keeps you from a completely clean audit report.”

Bond-rating firms also like to see a city issue bonds with fairly short repayment schedules, Nielsen said, and Perry’s profile suggests fiscal responsibility.

The city’s pension funds for police officers, firefighters and city employees now stand at 83 percent, he said, “and the rates of contributions are now a little higher than what is needed to fully cover amortized liabilities.”

The one gap in Perry’s financial reporting is missing data from the Perry Public Library Foundation, which has steadily refused to open its books to the auditor’s inspection. The Iowa State Auditor’s reports have noted this missing information for several years running.

“It’s the only thing that keeps you from a completely clean audit report,” Nielsen said.

Taxpayers customarily complain they are overtaxed, and activists such as Grover Norquist and many Tea Party populists have turned anti-government feelings into a virtual political party. In light of this widespread hatred of government, it is worth nothing that Perry residents receive a wide variety of public services for their tax dollars.

For example, the public safety department includes the Perry Police Department, the Perry Volunteer Fire Department, the Emergency Management Services and animal control.

The Perry Public Works Department includes the street department, the Perry Municipal Airport, garbage and recycling collection and maintenance of the city’s public buildings and grounds.

The Health and Social Services Department provides mosquito control.

The Culture and Recreation Department includes the city’s library, parks, McCreary Community Building and cemetery.

Perry’s planning and zoning are the responsibility of the Community and Economic Development Department.

The Department of Business-type Activities includes Perry’s sanitary sewer and stormwater sewer systems.

The Governmental Activities Department is the city hall administration.

Few Perry residents understand the value of the city’s services as well as Moorhead. “A high percentage of city employees live within the Perry community,” she said. “We have moved here or have grown up here. Our kids go to school here. We shop, volunteer and socialize here. Since we live here, we want Perry to have a government with efficient and effective departments that cooperate with each other. We are a tight-knit community, and the small town feeling is alive in Perry.”