To the editor:

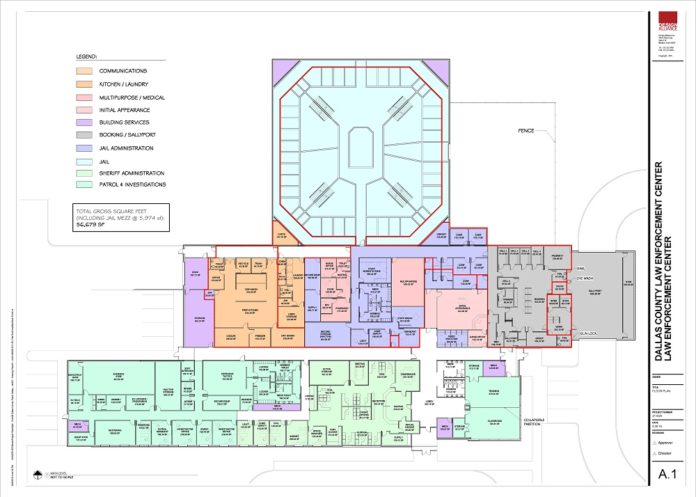

As a farm owner in Dallas Center and a business owner in Adel, I care a great deal about how my tax dollars are being spent. At present, Dallas County is sending roughly $500,000 a year to other counties solely to house inmates that the Dallas County Jail cannot house.

On top of the $500,000 of county tax dollars that are leaving Dallas County, the sheriff’s department is spending additional funds on personnel and transportation to accomplish these out-of-county transports.

These tax dollars are coming out of the county’s general fund, meaning that our individual tax dollars are being used while the $600 million of Tax Increment Financing (TIF) property does not contribute one penny.

On May 2, 2017, Dallas County has the opportunity to change the way our tax dollars are being spent and to ensure that all property owners are contributing.

By passing the bond referendum and constructing the new Law Enforcement Center, Dallas County taxpayers will save more than $22 million over the next 30 years. Within three years, the cost of paying for and operating the new facility will be the same as continuing to board our county’s inmates outside of Dallas County.

By passing the bond referendum, the new Law Enforcement Center will be paid out of the county’s debt service, meaning the $600 million of property value in the TIF districts will also be paying on the bond.

Our property taxes on residential and commercial properties will increase $14.85 per year per $100,000 assessed taxable value, and our annual property taxes for agricultural ground will increase $.20 per acre on ground that has a an assessed taxable valuation of $1,500 per acre. These increases will disappear in 2021, when previous county debts are extinguished.

I would encourage Dallas County taxpayers to vote Yes on May 2.

Kara McClure

Dallas Center

All I have to say is thank you Dallas County for raising our property tax assessment by over 22 percent just in time for the vote. The average assessment in our neighborhood dropped by over 1 percent. Out of the 30 properties I checked on, 19 of those dropped in value. Two of those by over 50 percent. I still maintain that using property tax instead of income tax is an unfair and an unjust form of taxation. There are far more people paying income tax then there are paying property tax. The state law needs to be changed on this. Property tax funding worked when almost everyone owned their own home.