To the editor:

I want to tell you why, as chairman of the Senate Budget Committee, I recently held a hearing on Social Security.

We take it for granted now but Social Security is one of the most popular and successful government programs in the history of our country. But, like many other important programs, Social Security is under attack by many Republicans who want to cut benefits or raise the retirement age. We cannot allow that to happen.

For more than 80 years, through good times and bad, Social Security has paid out every benefit owed to every eligible American on time and without delay.

Not once over more than eight decades of operation has anyone received a letter or phone call from the Social Security Administration saying: “Sorry, the economy is not doing so well, we need to cut your benefits.” That is a record we should all be very proud of as a nation.

Before Social Security was created in 1935, about half of our nation’s seniors were living in poverty. Today, though still too high, the senior poverty rate is just 8.9%.

Yet, despite all of this success, tens of millions of senior citizens are still struggling to make ends meet and many older workers worry that they will never be able to retire with any shred of dignity.

According to the most recent data, 12 percent of senior citizens in America are trying to live on an income of less than $10,000 a year and 55 percent of seniors are trying to get by on less than $25,000 a year.

Think about that for a moment. How do you pay the rent, put food on the table and pay for the basic necessities of life on just $10,000 or $20,000 a year? The answer is many cannot. In the richest country in the history of the world, this is not acceptable.

Further, about half of older Americans – those who are 55 and older – have no retirement savings, while the average Social Security benefit today is less than $1,540 a month.

Now, despite what you may have heard from Republicans, Social Security is not going broke.

Social Security has a $2.85 trillion surplus in its trust fund and can pay out every benefit owed to every eligible American for the next 13 years.

After that, the Social Security Administration estimates that there will be enough funding available to pay about 80 percent of promised benefits.

Given this reality, our job is not to cut Social Security as many of my Republican colleagues want to do. Our job is raise new revenue in order to expand Social Security so that everyone in America can retire with the dignity that they deserve and every person with a disability can retire with the security that they need.

And that’s what the Social Security Expansion Act that I have recently introduced with Senators Warren, Whitehouse, Merkley, Van Hollen, Padilla, Booker and Gillibrand is all about.

This legislation has been endorsed by the AFL-CIO, the Alliance for Retired Americans, Social Security Works, the National Committee to Preserve Social Security and Medicare, the American Federation of Teachers, the Economic Policy Institute, the National Education Association, the National Organization for Women, Public Citizen and dozens of other groups representing tens of millions of senior citizens, working families and people with disabilities.

According to a letter that I received from the Social Security Administration, this legislation will fully fund Social Security for the next 75 years and expand benefits for senior citizens and people with disabilities.

How do we do that? By making the wealthiest people in this country start paying their fair share of taxes.

Today, absurdly, there is an earnings cap on Social Security taxes of $147,000 a year. That means that a multi-billionaire pays the same amount of money into Social Security as someone who makes $147,000 a year. It means that someone earning $147,000 a year pays 6.2% of his/her income into Social Security, while someone making 10 times more will pay .62% into Social security – one-tenth as much. This is absurd, especially at a time of massive income and wealth inequality.

Our legislation ends this gross regressivity and applies the Social Security payroll tax to all income – including capital gains and dividends – for those who make over $250,000 a year.

Under this bill, 93.6 percent of households would not see their taxes go up by one penny. The tax increase in our legislation only applies to the wealthiest 6.4 percent of Americans – those who make over $250,000 a year.

Under this bill, because of increased revenue, Social Security benefits would be increased by $2,400 a year for both new and existing recipients – lifting millions of seniors out of poverty.

While most members of the Democratic caucus are on record in support of expanding Social Security, the Republicans have taken a very different approach.

Earlier this year, Senator Rick Scott, the Chairman of the National Republican Senatorial Committee, released a disastrous plan that would sunset Social Security every five years, raise taxes on millions of senior citizens and jeopardize the guaranteed income of 65 million Americans who depend on Social Security.

Just a few months ago, the Republican Study Committee in the House introduced a plan that would raise the Social Security retirement age to 69 over the next 8 years and privatize Social Security by allowing employers to divert payroll tax dollars into less generous private retirement accounts.

Last year, Senator Romney, who has opposed raising taxes on the wealthy to strengthen Social Security, introduced legislation to form a committee to propose cuts to Social Security behind closed doors.

In 2020, Senate Republican Leader Mitch McConnell told Bloomberg reporter Steven Dennis that he “hopes to work with the next Democratic President to trim Social Security, Medicare and Medicaid.”

In 2011, Senator Lindsey Graham introduced legislation to raise the full retirement age to 70 by 2032 and index it to longevity.

Poll after poll shows strong opposition to cuts in Social Security. Polls also show that Americans “support increasing, not cutting Social Security benefits by asking millionaires and billionaires to pay more into the system.”

Now, I know this is a radical idea for the United States Senate but maybe, just maybe, we might want to start listening to the overwhelming majority of the American people who want to expand Social Security and stop listening to right-wing billionaires who want to cut, privatize and dismantle it.

A great nation is not judged by the number of billionaires it has or by the quantity of its nuclear weapons. A great nation is judged by its compassion and how it treats the most vulnerable among us. And when we talk about the vulnerable, there is no group more vulnerable than senior citizens and people with disabilities.

Yes. The time has come to expand, not cut, Social Security.

U.S. Sen. Bernie Sanders

Burlington, Vermont

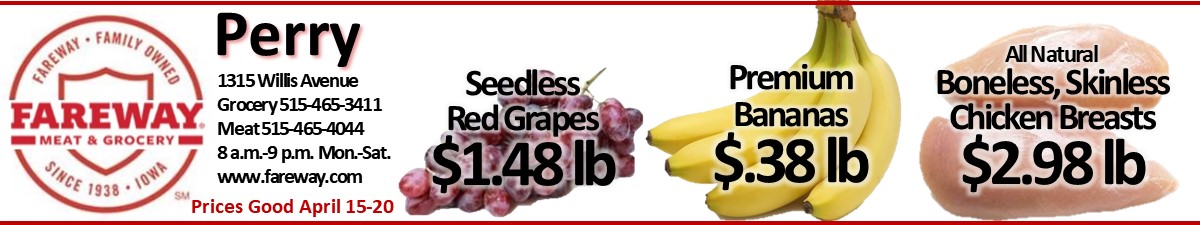

There’s no scare tactic about it here at all. The GOP opposed Social Security’s very implementation as well as everything else about FDR’s New Deal. Indeed, my elders told me many evangelical preachers decried it as the Mark of the Beast back then. Once in force, it was virtually too sacrosanct even to consider messing with all the way up to the Reagan years. Once Reagan was in office and the Democratic Party had weakened itself by corruption and complacency, Social Security became a viable target for the GOP. Then the rhetoric against it was really ratcheted up after the GOP controlled Congress. There are people in the very city of Perry who are quite open about their willingness to be rid of it. As for the prices, they may fluctuate a little, but I wouldn’t count on them being consistently any lower than they are right now. There will always be the constant back and forth between higher prices and higher wages. It’s always been that way. It will always be that way. I’ve lived through several of those cycles since the 1960s. There is nothing new under the sun. Regardless, inflation may be high, but corporate profits were at record levels the last quarter of 2021. Profits have slumped the first quarter of this year, but they’re still pretty hefty.