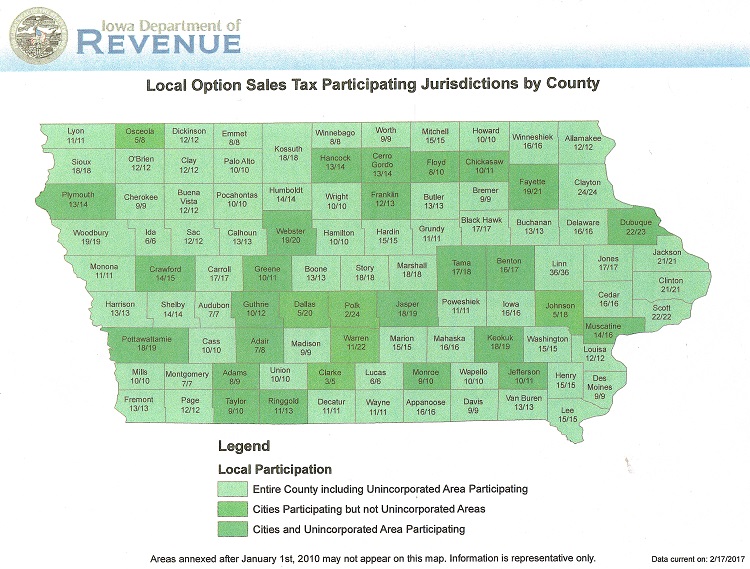

With Dallas County voters facing the opportunity Nov. 7 to vote themselves a 1 percent local option sales tax (LOST), supporters of the tax have been busily organizing meetings to explain the measure to their fellow citizens.

De Soto businessman Robert Greenway spoke May 8 to the Woodward City Council as part of the countywide petition drive to get the measure on the November ballot.

Greenway noted the tax already yields about $1 million a year in Perry, $440,000 in Adel, $104,000 in Redfield and $14,000 in Bouton. He said most counties in Iowa are already at 7 percent sales tax, and Woodward would be a net gainer by approving it.

Woodward Mayor Brian Devick first pitched the LOST idea to Woodward voters at a July 7 meeting in the auditorium of the Woodward-Granger High School. Devick organized the meeting to explain a variety of public projects, such as the planned improvements to the city’s wastewater lagoons, but he also had a chance to encourage residents to get the LOST measure on the November ballot by signing the petition.

Devick was joined Oct. 19 by Woodward City Council members Craig DeHoet and Todd Folkerts for a second public meeting, this time devoted exclusively to discussing the LOST tax.

“Most people, when they understand the benefit the city gets, most people are for it,” Devick said. “I know my council are all for it, and that’s everybody on the council, and I’m for it.”

He said while some citizens will oppose on principle any tax whatsoever for any reason whatsoever, most people he meets simply do not understand the benefits of the LOST tax and how it works.

“I wish there would have been more of an effort countywide to publicize it,” said DeHoet at the public meeting, “because there are a lot of people who have absolutely no idea it’s on the ballot. There didn’t seem to be any organized effort, other than the signature drive to get it on the ballot.”

Cities vary in their plans for using the LOST revenues. At the public meeting in Woodward, city leaders handed out a page with Woodward’s revenue statement, followed by tables showing Woodward’s local levy rates and a comparison of rates with other towns:

Many but not all the towns put a portion toward property tax relief or debt service, with investment in infrastructure and capital improvements also a common aim. To review the ballot language for each city and for the unincorporated part of Dallas County, click here.

“While I think the LOST tax is a good idea,” Devick said, “it’s more important to me to provide good information to people so they can decide for themselves and vote knowing what they’re voting for rather than a vote when they don’t know.”

For voters in some towns — Bouton, Dawson, Perry and Redfield — the question Nov. 7 will be whether to extend the LOST tax they already pay. Voters in 12 other towns in Dallas County, including Woodward, and in the unincorporated portion of the county will decide whether to impose the 1 percent sales tax on themselves for the first time.

The LOST tax revenues are a boon to cities that collect it, according to advocates of the sales tax. Perry City Administrator Sven Peterson said Perry’s LOST revenues fund everything from city street repairs to equipment purchases, and losing the LOST revenue would open up a large hole in the city’s finances. For a brochure detailing the numerous projects funded by LOST revenues in Perry, click here.

The laws governing LOST taxes are complicated, and Devick explained the formula used by the Iowa Department of Revenue for collecting and distributing the tax dollars within a county.

Distribution Formula = (.75 x P x Z) + (.25 x V x Z) where:

P = % of census population (75% of census population)

V = % of property tax (25% of taxes levied)

Z = total $.01 tax collected

The Iowa Department of Revenue has a useful website for questions about LOST, and a series of informational meetings on the tax are scheduled for Tuesday and Thursday this week at 6 p.m. at the Perry Public Library.