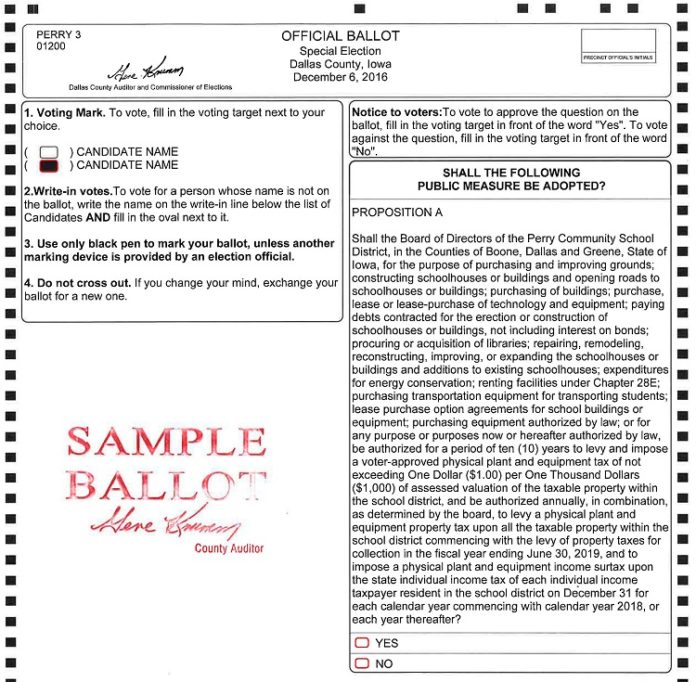

A special election will be held Tuesday, Dec. 6, 2016, for the purpose of Public Measure for a PPEL. A sample ballot can be found by clicking here.

- Polling Location: McCreary Community Building, 1800 Pattee St.

- Polling Hours: 7 a.m. – 8 p.m.

Any voter who is physically unable to enter a polling place has the right to vote in the voter’s vehicle. For further information, please contact the Dallas County Auditor’s Office at the telephone or TTY number or E-mail address listed below:

- Telephone: 515-993-6914

- TTY: 711+515-993-6914

- E-mail address: dcauditor@dallascountyiowa.gov

Public testing of the voting equipment will begin Dec. 1, 2016. This test will be conducted at the Dallas County election’s office at 210 N. 10th St. in Adel. Testing will begin at 10 a.m. and continue until completed.

This notice is given by order of the Dallas County Commissioner of Elections on this 15th day of November, 2016.

Gene Krumm

Dallas County Auditor

Commissioner of Elections

We just had a major election when hundreds of Perry citizens were at the polls. Why a special election on a Tuesday, in early December when people are thinking about Christmas shopping and glad the election season is over? It couldn’t be that the school board is trying to sneak a huge, three-part tax increase past the residents of the district, or are they? With this ballot measure, the school board is playing the role of “Bad Santa” on district taxpayers.

It took almost 100 words to describe the Christmas wish list that they want to use the tax increase for and continue it for 10 years! The list is amazing. Buildings, roads, paying debts, purchasing property and equipment and more are all included. For the next 10 years, the school board does not have to have voter approval. They can do whatever they want on this list!

This is a complicated and mysterious three-pronged tax increase on property owners of the district. The first increase is understandable. It is an increase of $1.00 per $1,000 assessed valuation on all taxable property in the district.” If your house’s assessed value is $50,000 you pay an additional $50 in property taxes for 10 years. If it’s assessed valuation is $100,000, you pay an additional $100 for 10 years. Every single property — residential, business and agricultural — is included. This is a huge tax increase all by itself, but there are two more prongs to this measure.

Prong two reads, “and be authorized annually, in combination, (addition?) as determined by the school board, to levy a physical plant and equipment property tax upon ALL the taxable property in the school district commencing with the levy of property taxes for collection of the fiscal year ending June 30, 2019.” There are no numbers connected with this tax increase. This is a blank check for the school board to impose as they and they alone decide every year. With no sunset provision, this is a permanent tax increase.

The first two prongs are bad, but the third really sticks it to taxpayers in the district. It’s an INCOME TAX SURCHARGE! Again, we are not told how much of a surcharge, but it will be imposed on every taxpayer in the district. This increase also has NO sunset or end included! It’s a permanent tax. If a person doesn’t own property but pays income taxes to the state, he will pay this tax. If a person owns property, he gets two property tax increases AND a surcharge on his income tax!

Summation: two property tax increases and a new income tax surcharge. Nothing is said about how much these increases are expected to raise, but it has to be an incredible amount.

This is an unreasonable overreach of the school board deep into taxpayer pockets. Perry has hardly begun to recover from the housing bubble of eight years ago, and property values are not rising dramatically in this community. Incomes in this community are thousands of dollars lower than other cities in the county. These taxes will surely make people think twice before buying a home here, starting a business here or living here. This increase is too much, and there is too much information missing from this proposal for this taxpayer to swallow this Christmas.

Here, Here! I was waiting to see if someone else read it the exact same way I did. The school alone already has us taxed to the hilt. Now they want a bigger slice of the pie? What about public safety, i.e. fire, EMS, police? The majority of their funding comes from taxation, and you’re trying to force your way into taking money away from not only those entities but others as well? I know you’re hoping that voter turnout will be low. It ups your chances, but I hope the citizens of the Perry Community School District vote No! This is way too big a pill to swallow.

Mike, you seem to have been misled by Rev. Tjapkes. This is not a tax increase or a new tax at all, and it certainly does not rob our public safety agencies. Please see my comments to Rev. Tjapkes for a fuller discussion.

I’m afraid you’re wrong, Chris. This is not a tax increase at all. As I understand the matter, this ballot proposal merely renews or extends for another 10 years the PPEL levy that Perry Community School District voters first approved 10 years ago. The ballot language, in all its execrable legalese, is typical of such matters. I believe it is boilerplate language, the same used on the Woodward-Granger PPEL a couple of months ago. As I understand it, this proposal does not impose a new tax or increase an existing tax. The money raised can only be used for facilities, equipment and technology. For 10 years, the PPEL levy has helped the district buy new buses and laptops. It’s helped the district maintain its buildings and facilities. In my opinion, district voters would be wise to approve the ballot proposition just as they approved it 10 years ago.

Yet you say you have plumbed this three-pronged mystery and caught out the school district in its sinister plan “to sneak a huge, three-part tax increase past the residents of the district.” You describe the proposal as “two property tax increases and a new income tax surcharge,” and you call it “an unreasonable overreach of the school board deep into taxpayer pockets.” This overheated rhetoric risks misleading your fellow citizens for the reason I have mentioned: the factual error on which your denunciation is based. I repeat: this is neither a new tax nor an increase of an existing tax.

Whether the special election is sneaky or unreasonable is a matter of judgment, but whether it is a tax increase is a matter of fact. The former I would leave to free discussion, but the latter I will be ever vigilant about and will always seek to correct errors and misstatements of facts, which will naturally occur from time to time through simple human frailty or a deliberate intention to deceive. Public education is a most important issue for a self-governing people. Some citizens oppose public education on principle, and other support it on principle. Airing all such opinions is a very important part of the process of arriving at conclusions and making decisions, but the best decisions are always based on facts and not on errors. I believe you are in error in calling this a tax increase. By doing so, you might succeed in inflaming the passions of the anti-tax zealots against the measure, but you do so by means of a misstatement of the true state of affairs.

This entire ballot initiative is already in place? I understand now that the first part is renewing an existing levy. The information on the ballot question does not say that. But the other two provisions are already in place as well? This is the first time I’ve heard of a surcharge on state income taxes. If all of this is a renewal of current taxes, then I will rescind my assertions with my apologies. More information on the story in ThePerryNews or on the ballot question may have averted this misunderstanding. How many other taxpayers and voters are going to misunderstand?

Yes, perhaps ThePerryNews should have covered this question fully before publishing the legal notice and the sample ballot sent out by the auditor’s office. At any rate, a story is now in the works, and we hope to bring the question clearly before the minds’ eyes of our readers so that they can make an informed decision. Voters in the Woodward-Granger School District approved a similar measure in September, as reported in ThePerryNews, and we hope voters in the Perry district are similarly willing to support the schools with this necessary funding.

You are correct, Jim. I apologize for not doing my full homework on this matter.

Thanks, Mike. And I apologize for not publishing a thorough story on the question before springing the sample ballot on readers, but there’s one in the works now. Thanks for reading ThePerryNews.com!