ADEL, Iowa — In August the Iowa Economic Development Authority (IEDA) board canceled a previous incentive contract with Tyson Fresh Meats in Perry after the company failed to maintain its promised workforce size, but the Dallas County Supervisors decided this week to let stand their $574,000 in property-tax rebates to Tyson, agreed to as part of the same 2018 deal.

As part of the IEDA High-Quality Jobs program, the state agreed in 2018 to provide $674,000 in income-tax credits to Tyson for its upgrading of the Perry plant with a new $44 million hog carcass chilling system. Dallas County’s half-million-dollar tax increment financing (TIF) rebates were tied in to the same three-party contract.

The contract with the company did not require Tyson to add any high-quality jobs in Perry but only obliged it to maintain its workforce at the 2018 level of about 1,400 workers. When the factory failed to maintain that number of workers — an impact of the 2020 COVID-19 disruptions — the IEDA terminated its contractual agreement at Tyson’s request.

Rob Tietz, the Dallas County director of finance and operations, reviewed the terms of the 2018 deal for the supervisors.

“In that development agreement, they were required per the agreement to maintain their job level as it was prior to the project,” Tietz said. “They didn’t have to create any new jobs. They just had to maintain their current job level. Last year, as you know, was a very extraordinary year because of COVID, and because of that they were not able to do that.”

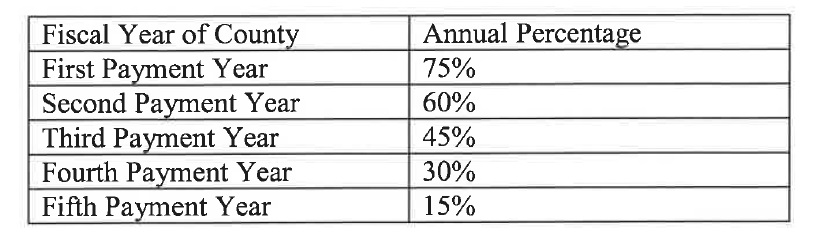

The Dallas County Supervisors’ pledge to rebate about $574,000 in TIF revenues — the amount of the property’s increased value after the improvements — was tied into the same agreement, which called for the property tax revenues to be paid back to Tyson over five years, from 2023-2027.

The state asked the supervisors to terminate the 2018 agreement, which they did Sept. 14. At that time, Amy Bjork, a public financing attorney with the Dorsey and Whitney law firm, laid out the options for action to the supervisors.

“There’s a decision to be made by the board,” Bjork said, “to determine how you want to handle the TIF agreement outstanding with Tyson, whether you want to look at terminating it, reducing the payment amount or leaving it the same. Lots of options here.”

Bjork said that terminating the development agreement would relieve the county of any TIF obligations to Tyson, “so TIF dollars would be available for the county to use for another urban renewal project in the urban renewal area, or they would go back into the regular property-tax stream and be distributed that way.”

Supervisor Mark Hanson of Waukee, representing the voters of supervisor district two, asked whether the county could stick with its deal with Tyson despite the state’s having withdrawn.

“Even if they breached this agreement with IEDA, it still could be allowable if we felt that was in the best interest of Dallas County, I guess,” Hanson said. “Plants come and go, and when you make that kind of investment in that property in that town, I felt pretty good about that because it would guarantee employment for a lot of people in that town for a long time.”

Hanson’s fellow supervisors shared his desire to reward the county’s second-largest employer for their sizeable capital investment.

“I’m just trying to understand why the county wouldn’t want to continue to work with Tyson on this project,” said Supervisor Kim Chapman of Adel, “and I’m not coming up with a good reason myself not to. Does anybody see something I’m not seeing here? Am I missing something?”

“I think I’d tend to agree with that,” said Supervisor Brad Golightly, who represents the voters of supervisor district one, in which the Tyson plant is located. “They’re good corporate citizens.”

The revised agreement between the county and Tyson takes the taxable base valuation of the Tyson plant, used to calculate the annual TIF payment, at $5.235 million. A declining portion of the annual TIF revenues will be paid over five years:

Tyson’s $44 million expansion in 2018 was the second large investment in the Perry facility made by company in recent years. In 2017 Tyson completed a $23 million upgrade to the site’s wastewater treatment plant.

Tyson’s $44 million expansion in 2018 was the second large investment in the Perry facility made by company in recent years. In 2017 Tyson completed a $23 million upgrade to the site’s wastewater treatment plant.

The Springdale, Arkansas-based corporation is the world’s second-largest meat processor. Annual revenues were $43.2 billion in 2020. The company employs about 120,000 workers in the U.S., including some 1,200 people at the Tyson Fresh Meats in Perry.